Let’s break down seller financing in simple terms.

Seller Financing 101: The Good and the Not-So-Good

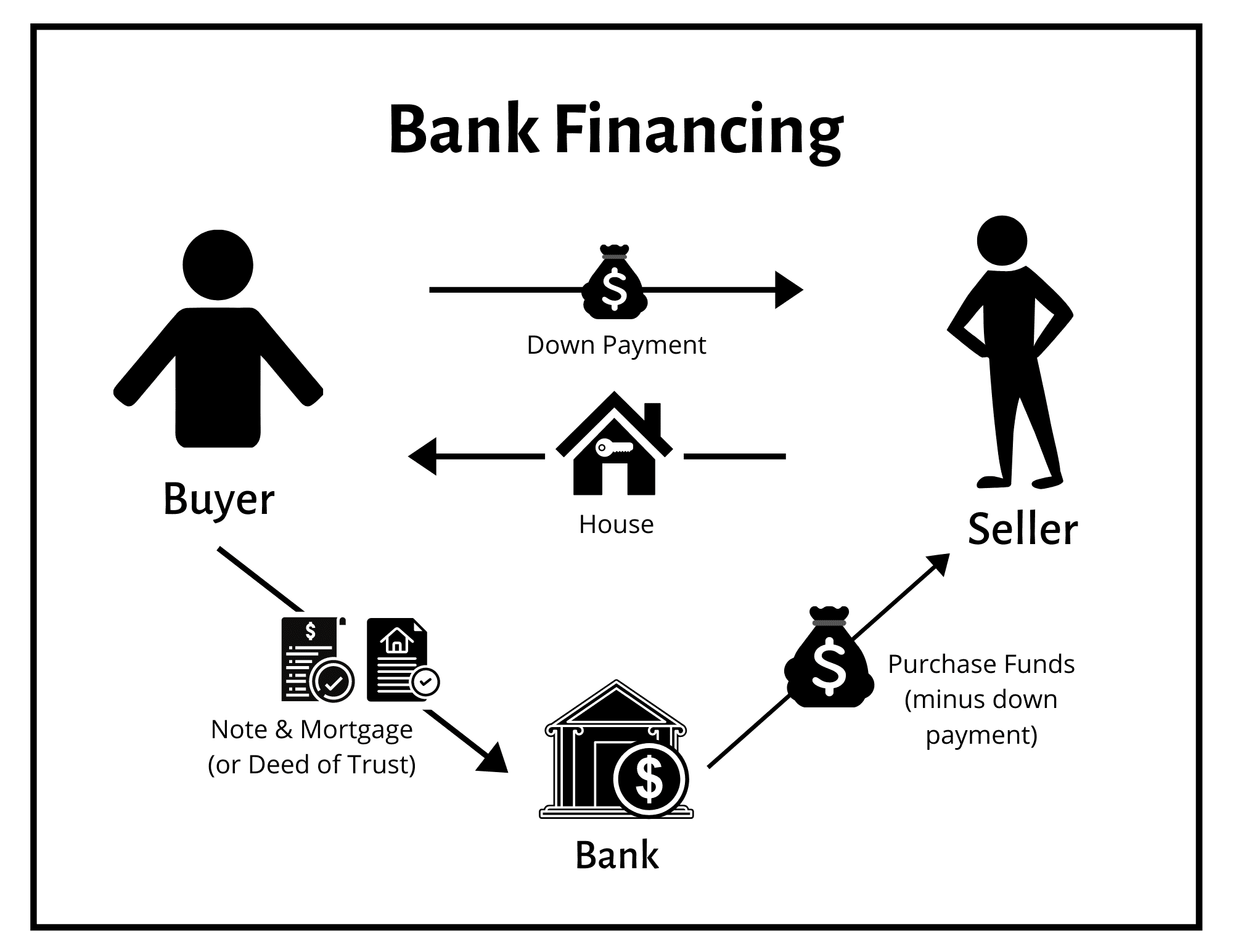

Seller Financing Explained: Seller financing, also known as owner financing, is a real estate transaction where the seller acts as the lender. Instead of the buyer getting a mortgage from a bank, they make regular payments directly to the seller until the agreed-upon amount is paid off.

Pros for Those Free and Clear:

- Flexible Terms: You and the buyer can negotiate terms that suit both parties, like interest rates and payment schedules. It gives you more control over the deal.

- Faster Sale: Offering seller financing can attract more buyers, especially those who might struggle to secure a traditional mortgage. This could speed up t

- he selling process.

- Potential for Higher Sales Price: You might be able to sell at a higher price since you’re offering a unique financing option. This could mean more money in your pocket.

Cons for Those Free and Clear:

- Risks: There’s a risk involved in being the lender. If the buyer defaults, you might need to go through legal processes to reclaim the property.

- Delayed Full Payment: Unlike a lump sum from a traditional buyer, seller financing means you get paid over time. If you need the cash upfront, this might not be the best option.

- Interest Income Tax: The interest you earn may be taxed, and handling the paperwork correctly is crucial to avoid potential issues.

Pros for Those with a Mortgage:

- Attracting More Buyers: Just like for those who are free and clear, seller financing can make your property more appealing to a broader range of buyers.

- Potential Higher Sales Price: Offering financing might allow you to sell at a higher price, giving you more profit in the end.

- Income Stream: You’ll receive a steady income stream from the buyer’s monthly payments, which can be useful for covering your mortgage or other expenses.

Cons for Those with a Mortgage:

- Due-on-Sale Clause: Some mortgage agreements may have a due-on-sale clause, meaning the full mortgage balance becomes due if you sell the property. Check your mortgage terms.

- Risk of Default: There’s always a risk that the buyer might default on payments, leading to potential financial and legal headaches.

- Not Getting Full Cash Payment: If you need a lump sum of cash for your next real estate move, seller financing might not be the ideal choice.

Remember, every deal is unique, and it’s essential to consider your specific situation and goals. Happy selling! ¡Buena suerte en tus negocios! 🏡✨

If you would like to schedule an appointment to further discuss your options. Click this link here

.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link